Paying bills can be a tedious and time-consuming task, but it’s an important part of managing your finances and maintaining good credit. If you’re tired of feeling disorganized and stressed about paying your bills, it’s time to get organized. Here are some tips for getting organized in paying your bills:

Make a list of all your bills

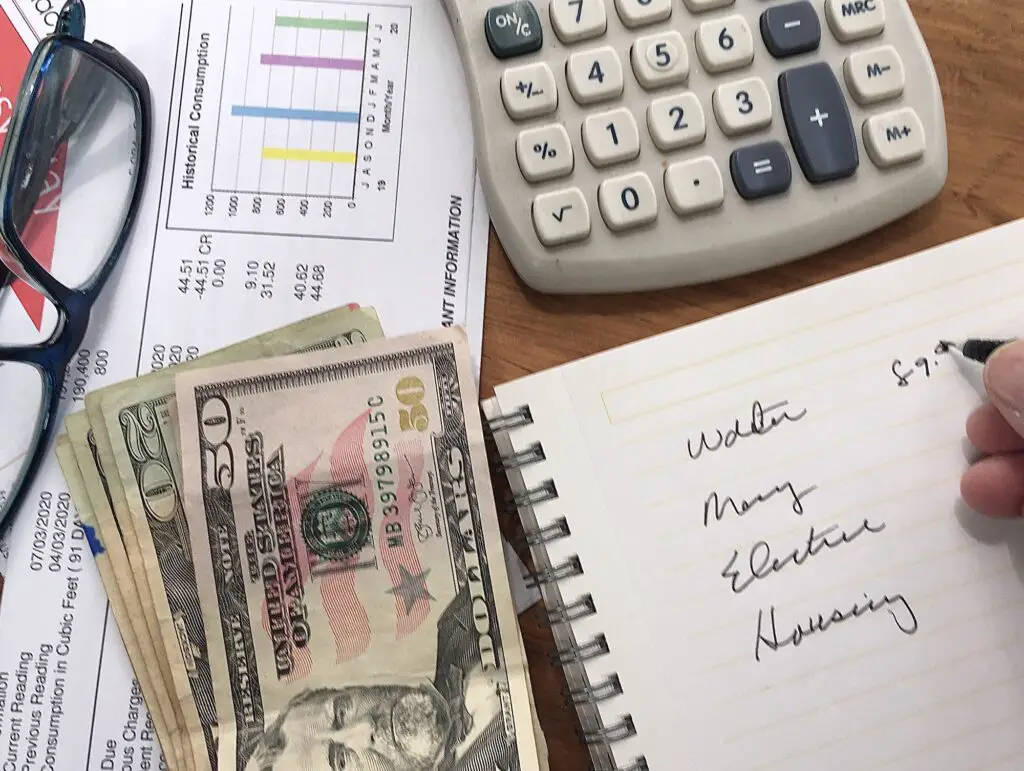

The first step to getting organized in paying your bills is to create a list of all the bills you need to pay. This should include the name of the company, the amount due, and the due date for each bill. Having a complete and up-to-date list of your bills will help you keep track of what needs to be paid and when.

Set up automatic payments

If you’re tired of remembering to pay your bills each month, consider setting up automatic payments. Many companies offer the option to automatically charge your credit card or bank account for the amount due each month. This can be a convenient way to ensure that your bills are paid on time, without having to remember to write a check or make a payment online.

Use a bill-paying app

There are many apps available that can help you manage your bills and make payments more efficiently. These apps allow you to see all of your bills in one place, set up automatic payments, and track your spending. Some apps even allow you to scan and upload your bills, which can be a convenient way to keep track of paper bills.

Set up email or text reminders

If you’re prone to forgetting to pay your bills, consider setting up email or text reminders. Many companies offer the option to receive reminders via email or text message, which can help you stay on top of your payments and avoid late fees.

Use a calendar or planner

If you prefer a more old-fashioned approach, consider using a calendar or planner to track your bills and payments. This can be a simple and effective way to stay organized and make sure that your bills are paid on time.

Final Thoughts

Paying bills can be a tedious and time-consuming task, but it’s an important part of managing your finances and maintaining good credit. By getting organized and using tools such as automatic payments, bill-paying apps, email reminders, and a calendar, you can make the process of paying your bills more efficient and stress-free.